Tackle Your Accounting Challenges. Successfully Increase Productivity & Profitability. Remain Compliant with Industry Regulations.

.gif)

Certified Luxury Builders’ accounting and finance team can help you increase productivity, raise profitability, and stay compliant.

Our unique approach is builder-centric, by and for builders. Owners, contractors, and subcontractors face unique accounting challenges that can hinder profitability and more often that not leave them asking - how do construction companies keep books? What is the most popular construction accounting software? What should I look for in construction accounting software? When you have the right team, processes and systems tracking, reviewing, and communicating what you need to know about your numbers, you can focus on the activity you’re passionate about.

Underpinning the growth and profit of Luxury Builders and Remodelers is effective planning, processes, accounting, financial analysis, reporting, budgeting, data analysis, and benchmarking. CLB clients are highly sensitive to shifts in their balance sheet and cash flow. Their ability to monitor financial performance in near real-time and plan ahead is crucial. Many builders fail to have the right resources, personnel, systems, and processes to make these activities strengths and they continue to struggle with the challenges.

At its core, CLB finance is a solution built for builders by builders. It is an easy-to-use but powerful cloud solution. CLB provides a growing family of connected solutions to help:

Our solution has multi-layer security, encrypted data and always backed up to give you the protection and confidence you need.

With CLB Finance, you don’t have to worry about your accounting and finance activities:

Weekly:

Payroll entry (into QuickBooks)

cost based on number of employees

Monthly:

WEEKLY:

REPORTS AND ASSISTANCE

WEEKLY:

REPORTS AND ASSISTANCE

REPORTS AND ASSISTANCE

*cost based on number of employees

The client is responsible for:

CLB will educate client on best practices process and procedures to be highly efficient and effective.

*CLB will provide a template document & record management file system and processes for the business and to be compliant.

*CLB will provide templates for job description, salary range, hiring process, and offer letter.

What if you had great numbers that you had confidence in, that you could act upon to make your business better? That you could use to help your team work better? What if you had a team of accounting and finance pros who had you covered from paying your bills to making sure your books were properly closed out in a timely fashion in a predictable time after every month?

Stop wasting time and worrying. Start focusing on running your business better!

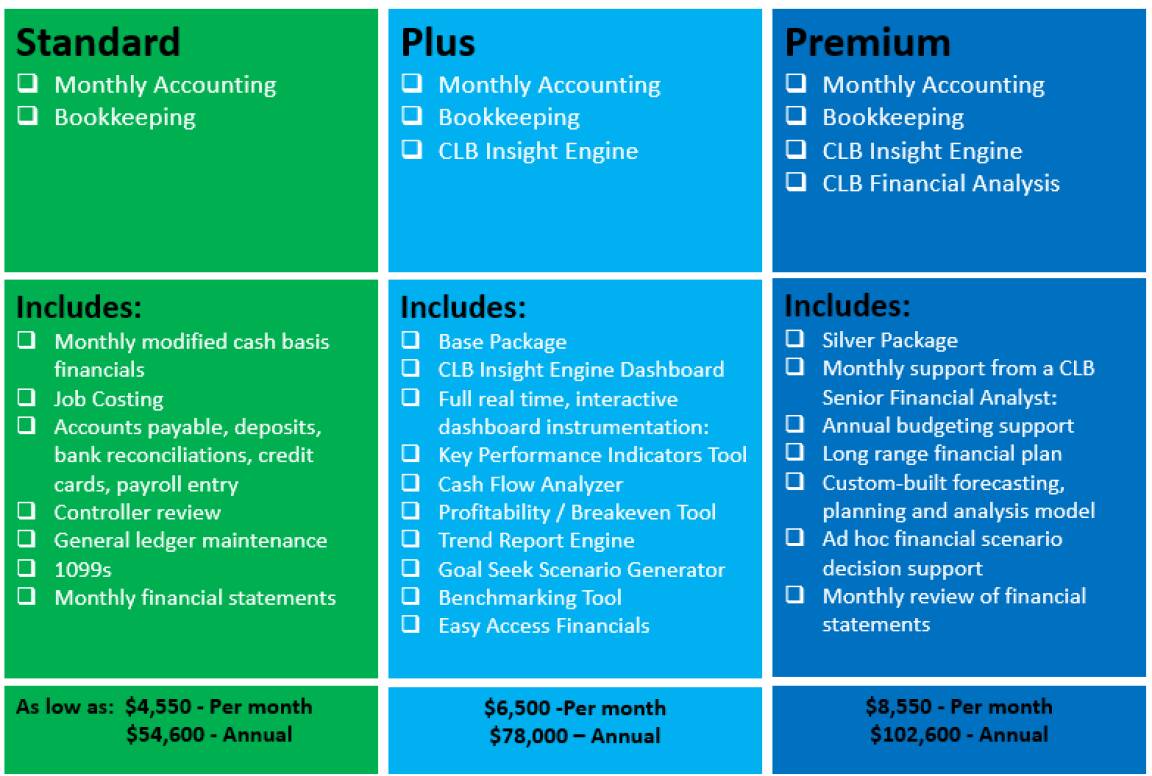

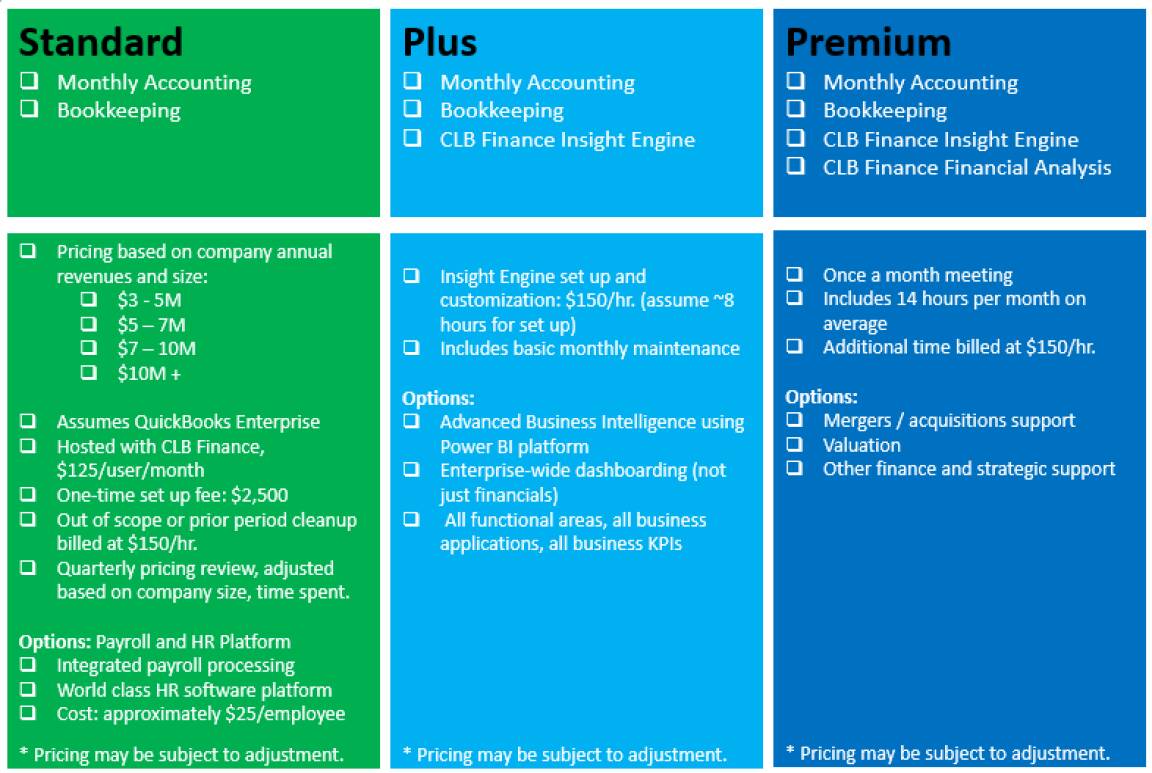

CLB Finance offerings consists of teams of finance and accounting professionals at all levels who are passionate about the businesses of our clients.

Our employees form teams of professionals capable of providing services normally associated with Chief Financial Officers, Controllers, Financial Analysts, Accountants, and Accounting Specialists. CLB Finance brings the concept of “timeshare” and “team” to each company according to its need.

CLB Finance business model is based on the reality that a typical small or medium business has a need for some fraction of each of these resources but of course, cannot afford to hire one of each. CLB has pioneered an approach that provides a total solution, complete with a team of specialists armed with specialty business processes and tools for a price that is affordable to small and medium-sized businesses.

CLB Finance delivers results that you may not think are possible. Dare to dream about having timely, relevant and accurate information focused on how you make decisions. Imagine having a truly integrated view of your business focusing on the goals and potential that you define. Imagine having a world-class strategic and analytical business partner singularly focused on getting the most out of your business.

All for a price you can afford.

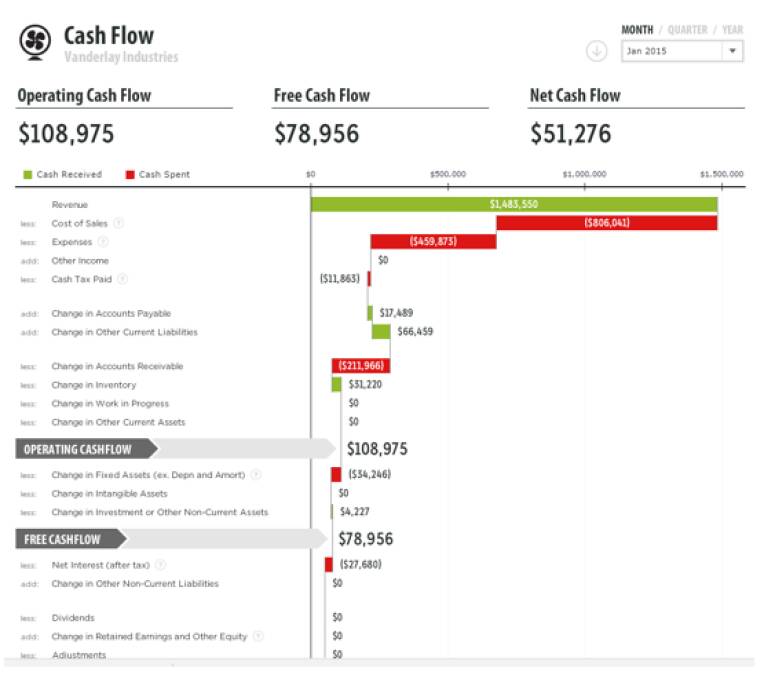

Our outsourced financial solution works exclusively with the building industry. We have experience helping companies like yours improve cash flow, reduce workload, apply best practices, and streamline processes. Ever wonder what happened to your cash? Looking at sales and expenses once a month only gets you so far. Cash gets tied up in things like accounts receivable and inventory. This powerful tool lets you walk all the way from your revenues to what ended up in your bank account—providing you a new level of insight into your business.

What if you had great reporting and analysis that you had confidence in, that you could act upon to make your business better? That you could use to help your team members work better?

What if you had great reporting and analysis that you had confidence in, that you could act upon to make your business better? That you could use to help your team members work better? What if you had someone who was analyzing your numbers, covering all the bases for you, watching for even the smallest changes like a hawk? What if you had an expert in your business who owned the numbers and could leverage our expertise to help you reach your goals?

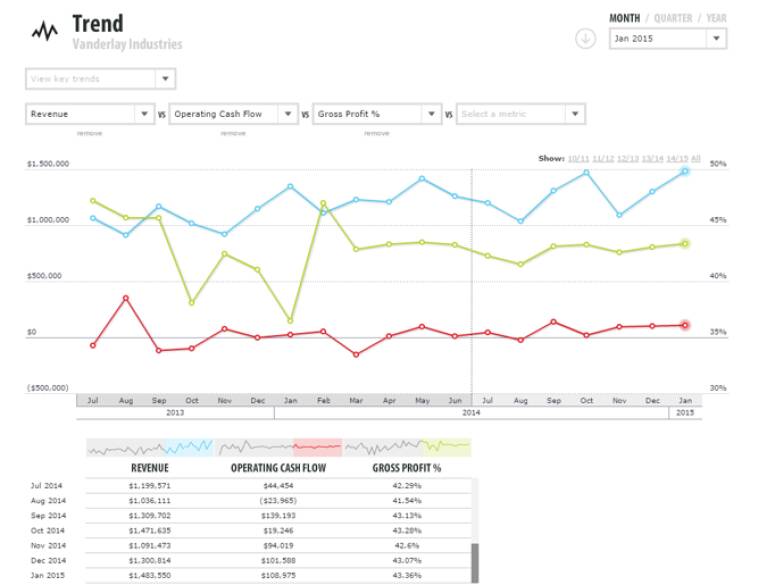

Quickly and easily see the trends in your business that matter over time. Correlate activity and dates to the results to better plan and execute.

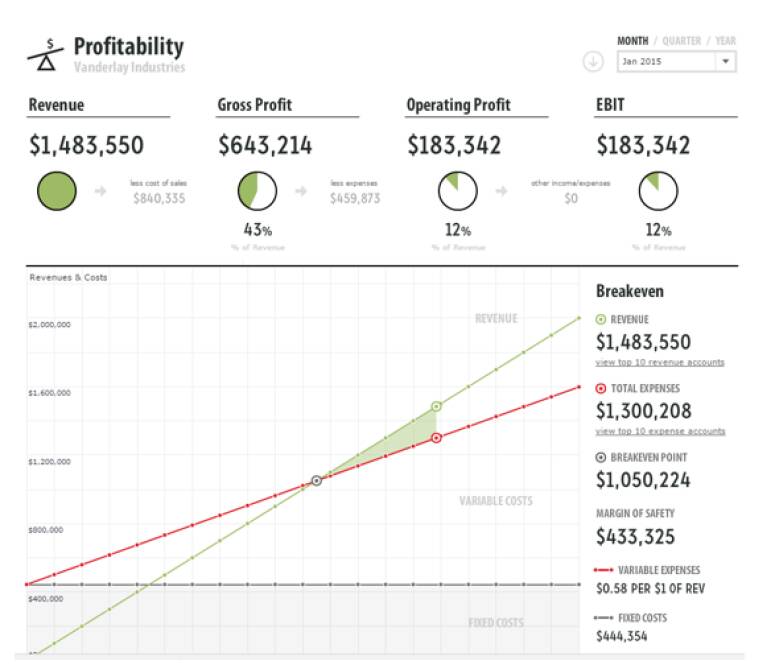

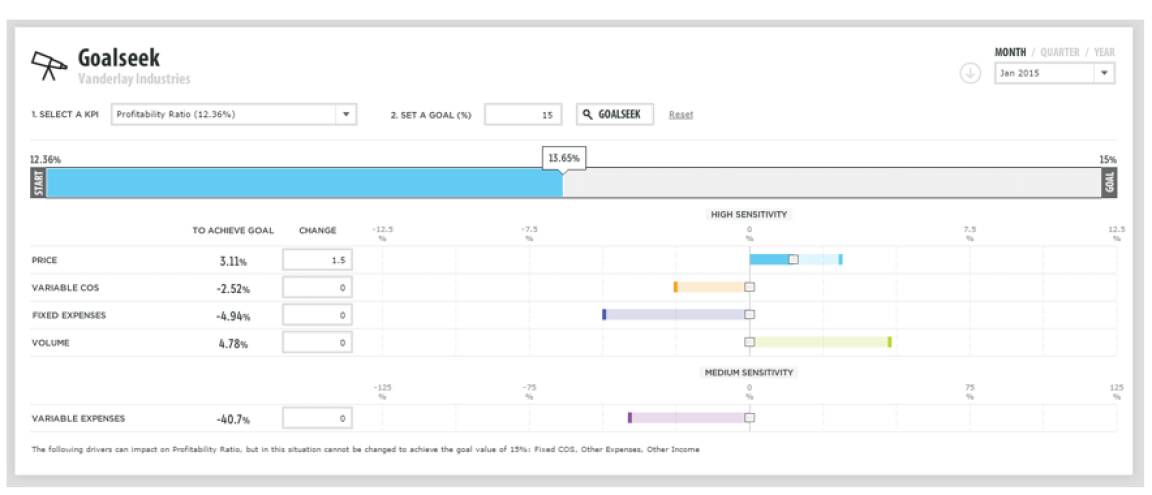

Do you know when and at what point your expenses flatten and your net profit accelerates? What if we increased your profitability to 10%? Is that achievable? What do I need to do to get there? We understand your profitability and cost structure. With CLB’s Insight Engine, you can leverage this knowledge to explore the potential for your business. You can evaluate various goals that are aggressive yet achievable-- and instantly understand the requirements to get there. Having a strategy to build assets and create value supports your legacy and selling your company one day.

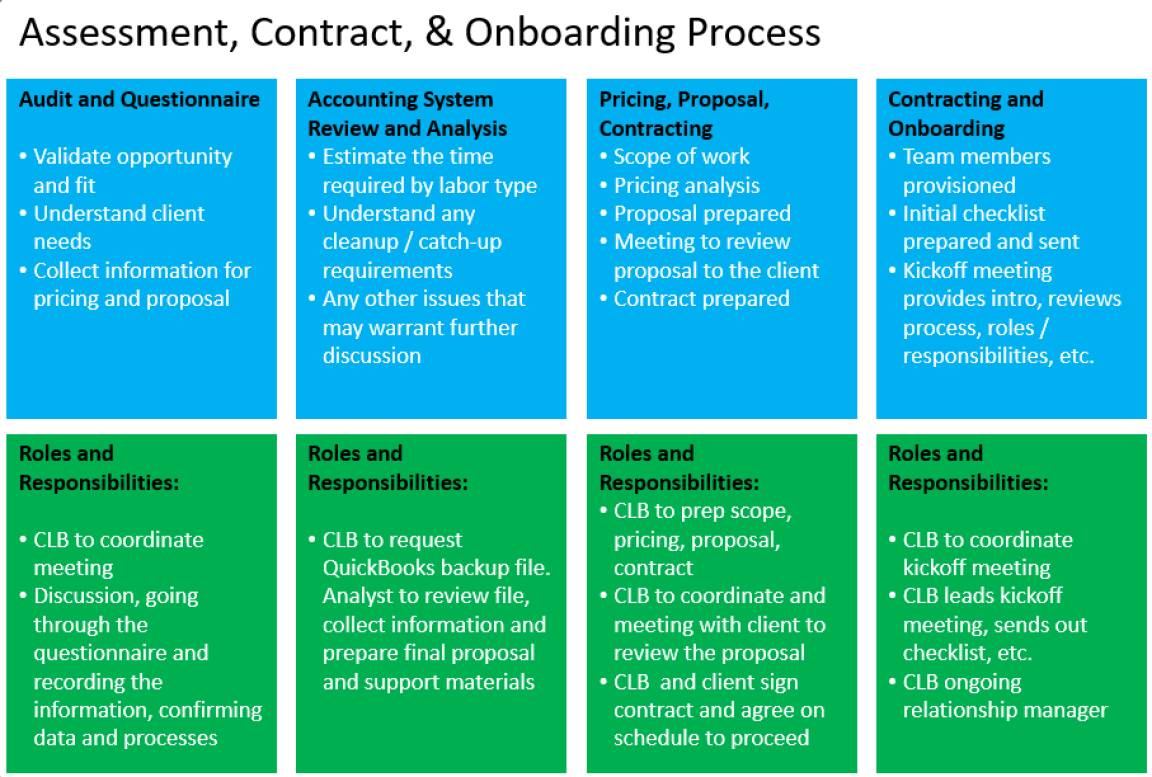

You already took the assessment and got your results. Let’s take the next step to see it this is the right fit and budget for you.

CLB would like answers to specifics questions to help us scope and size your solution. Please let us know if you have any questions.

In this guide we walk you through everything you need to know to run a successful and highly profitable business - the foundation of construction accounting, why it is different, and the 5 key financial ratios you can use to measure the performance of your business within the construction industry.